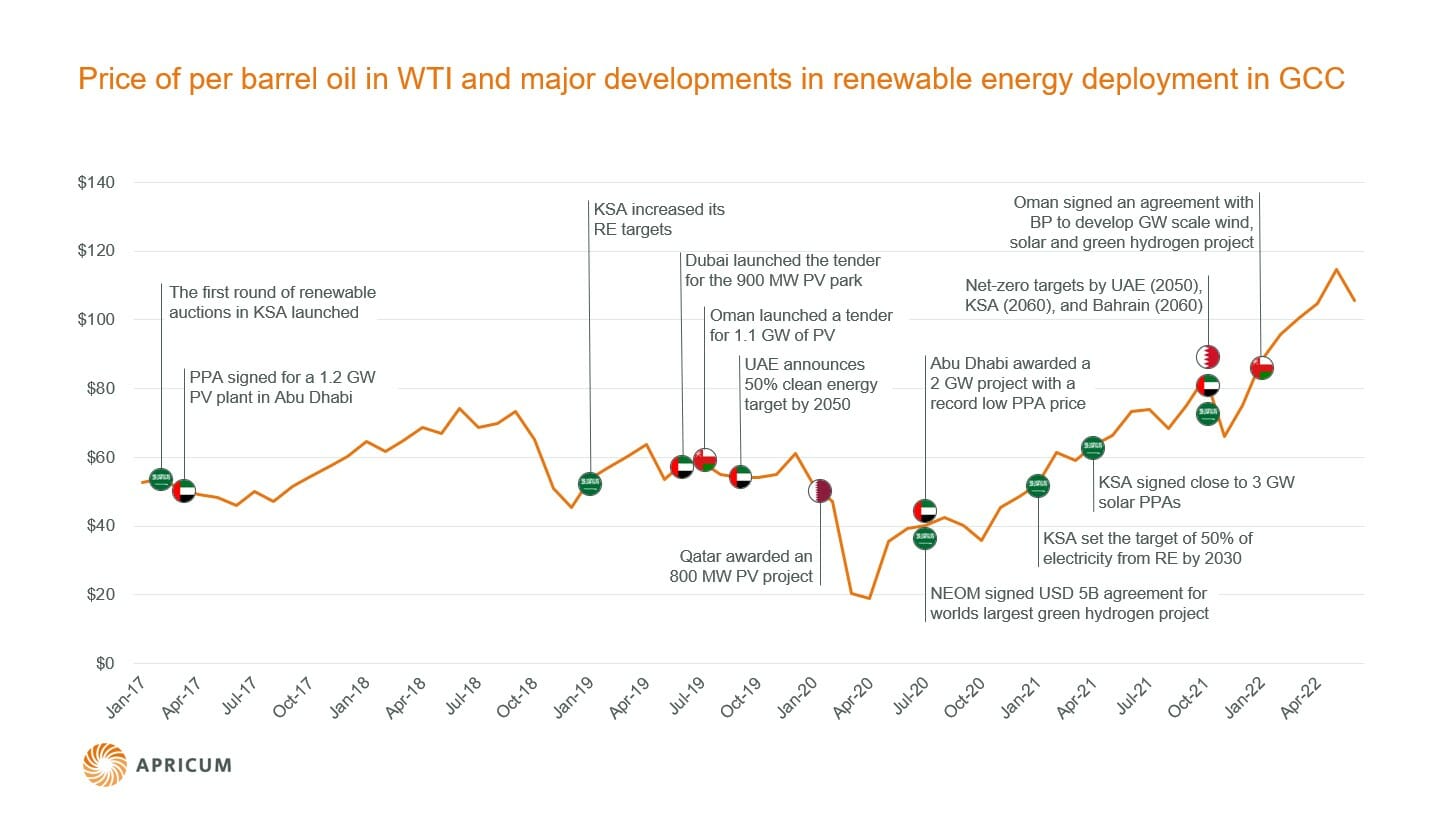

On November 20, 2014, ten bids for the 100 MW PV IPP tender issued by Dubai’s state utility DEWA were opened. The results provoked awe throughout the Gulf region’s power community and will set the standards for future tenders. Saudi Arabia’s Acwa Power bid an unprecedented 5.98 USD cents/kWh, with a consortium of Spain’s Fotowatio Renewables and Saudi Arabia’s ALJ Energy coming a close second with 6.13 cents/kWh. The low tariffs, bid in a fully commercial, unsubsidized setting, disprove persisting misconceptions in the region about the allegedly high cost of PV and should provide a boost to other governmental procurement programs in the Gulf, in particular, in Saudi Arabia. Apricum Partner Dr. Moritz Borgmann analyzes the results and gives his view on the keys to success behind the stunning results and the wider implications for the region.

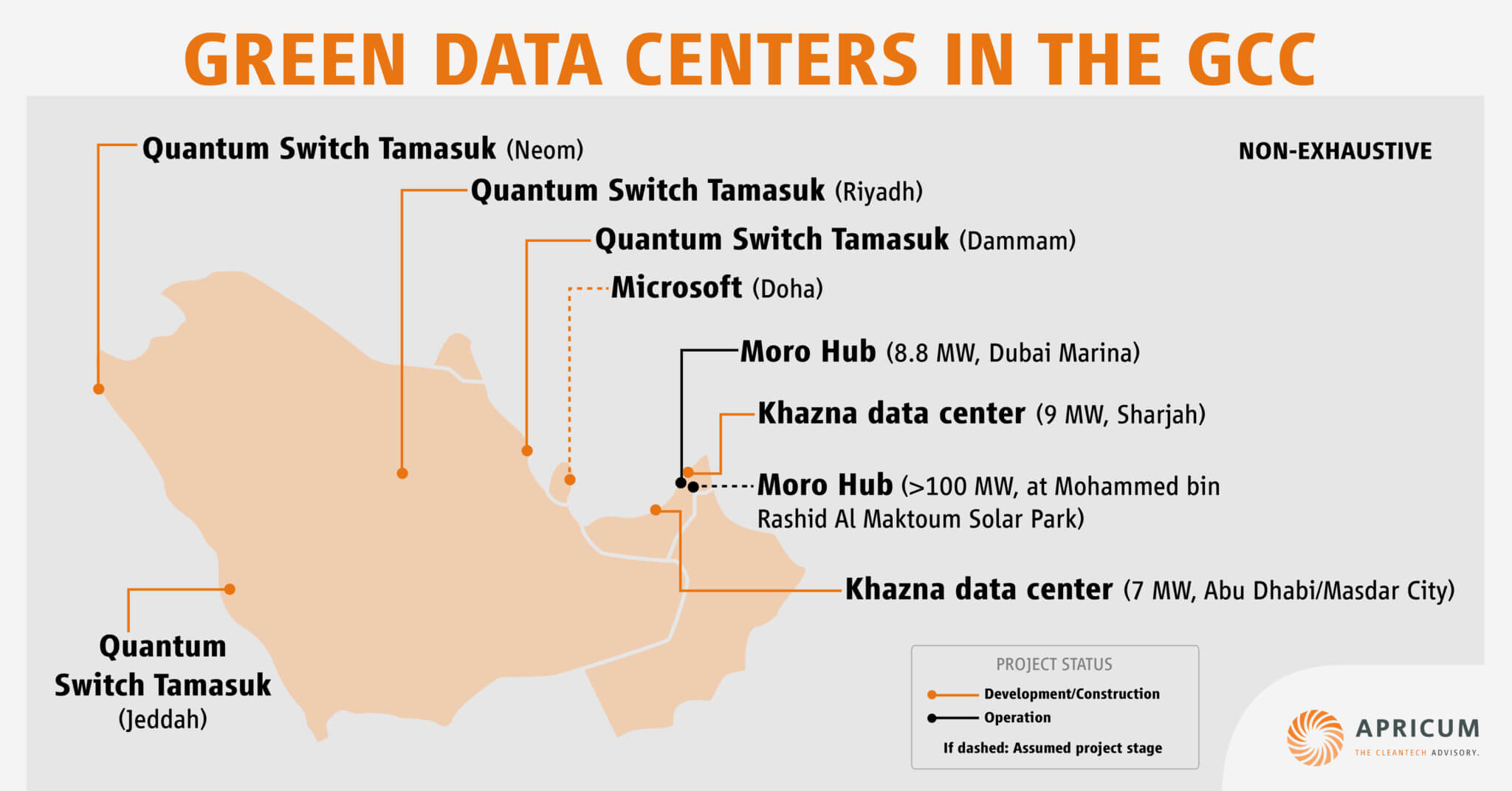

After Saudi Arabia had announced ambitious plans for renewable energy, only to delay their implementation over and over again, the emirate of Dubai is now emerging as one of the forerunners for renewable energy in the Gulf region. As part of its program to reach energy diversification goals for 2030, Dubai launched the Mohammed bin Rashid Al Maktoum Solar Park in 2012. The park is located on 40 square kilometers of land south of Dubai city and is planned to eventually host 1 GW of solar projects.

In the spring of 2014, DEWA as Dubai’s electric utility company launched a public tender for constructing Phase II of the Sheikh Maktoum solar park with 100 MW of photovoltaic capacity under a build-own-operate (BOO) model. Independent power producers (IPPs) were solicited to provide bids, with the bidder submitting the lowest tariff on a per-kilowatt-hour basis to win the project. The winner would finance and construct the power plant, and then receive a fixed tariff under a 25-year power purchase agreement (PPA) starting in 2017. Following usual practice in the region, DEWA itself intends to take a 51% equity stake in the project.

The world’s most inexpensive solar energy

This tender was a welcome opportunity for the international PV developer community and many aspiring local players, starved by years of unfulfilled hopes for large-scale projects in the Gulf region. Consequently, a stunning 24 consortia prequalified for the bid, providing a glimpse of the competitive pressure to be expected. However, bid requirements and pre-bid costs were high, so a majority of developers dropped out of the process, with ten remaining consortia finally submitting their bids on November 20, 2014.

The following public read-out of the bids provoked awe in the room and is now sending ripples through the Gulf power sector. Saudi IPP powerhouse Acwa Power, true to its reputation for aggressive bids, continued its winning streak from the conventional IPP space and bid a record-low tariff of 5.98 USD cents/kWh, with a consortium of Spanish developer Fotowatio Renewables and Saudi new entrant Abdul Latif Jameel Energy coming a close second with 6.13 cents/kWh. Quite a gap separated the other applicants, with the likes of Masdar/Isolux Corsan, First Solar, SunEdison and EDF bidding in the range of 8–9 cents/kWh. The results also indicated that a few applicants were apparently out of sync with the market, as demonstrated by bids as high as 14.7 cents/kWh.

The extremely low winning bid and the close second bid mark world-wide record lows for the cost of solar electricity, with recent records in India and Brazil set around the 8–9 cents/kWh mark. While very aggressive, the bids are realistic and forcefully demonstrate the continuing and tremendous pace of technical, commercial and financial innovation in the PV industry. The low price level will create additional incentives for governments in the Gulf region to drive their renewable-energy programs forward, and combined with the solid nature of the bids provides a clear answer to naysayers who until this day have doubted the viability of solar energy in the region.

A driver for new momentum in Gulf region solar programs

As an additional coup, Acwa Power not only provided the lowest bid, but also provided alternative bids in which it proposes to immediately build 200, 800 or even 1,000 MW at the foreseen site, at a tariff of 5.4 cents/kWh for the 1,000 MW variant. This alternative proposal, which became public only through a glitch in the readout process, is testament not only to the commercial competitiveness of solar energy in the Gulf region, but also to the confidence with which serious market players would commit to extremely fast large-scale deployment of solar PV power.

Existing, outdated roadmaps and assumptions for the cost and complexity of solar that many of the regional governments have so far based their plans on will need to be revised; there is little excuse now to further delay solar procurement programs. Given the low cost, the obvious scalability and the readiness of solar PV power, governments have every reason to significantly accelerate the rather timid procurement plans existing or contemplated to date.

In particular, Saudi Arabia is now even more in the spotlight for failing to deliver on its promise of a 42 GW solar-energy procurement program, which has stalled since the responsible government entity K.A.CARE went into hiding in 2013 amid political struggles behind the scenes. The fact that its smaller neighbor Dubai can create such an apparent success should be an additional incentive for Saudi Arabia to move forward, given the traditional rivalry among Gulf monarchies for prestigious projects.

Fortunately for the further development of solar power in the Gulf region, Dubai’s DEWA chose to closely follow regional precedents for IPP projects, previously set by Saudi Arabia’s SEC and also in Abu Dhabi and Oman. The tender structure, well proven and bankable for conventional power projects, only needed relatively minor adjustments for PV technology. Apricum anticipates that the DEWA precedent will be adopted and further developed in future solar IPP projects in the region.

Uncompromising excellence in all domains drives ultra-competitive pricing

The key question that aspiring competitors and local governments will ponder in the coming months is how such a competitive price level could be reached for a PV power plant, by an obviously serious market player.

The answer is that in an intense competitive environment, every bit of fat needs to be cut out of all cost components of a PV power plant, and performance needs to be maximized. The times of high FITs or lenient legacy PPA rates are definitely over in the solar project landscape, as evidenced by the results in the DEWA tender, but also recent results in India, Brazil and South Africa.

Successful developers work with the best international EPC companies and tirelessly pressure them on price, questioning every component of the PV plant and pressuring component suppliers. Year-long optimization processes in already competitive markets have led to very low-cost system design approaches employed by the most competitive PV EPC companies. Consequently, the most competitive EPC prices are now fast approaching the 1 USD/Wp mark.

A particular challenge for PV projects in desert regions is operation and maintenance, in particular cleaning of the PV modules to mitigate the impact of soiling. Naïve cleaning concepts lead to inferior performance and high O&M cost; experienced developers plan for sophisticated O&M concepts that reach near-optimum performance levels at low cost. The particular site of the DEWA project was suited to a low-cost O&M concept because the climate is rather dry, and the dust in the environment does not stick to the modules, but rather can be removed fairly easily.

A further key ingredient of a low tariff is low-cost finance. In the politically stable environment of Dubai, very inexpensive loans proved to be available, with some regional banks confirming a large appetite for project finance deals with attractive terms. Local banks have been rumored to provide financing at an average margin as low as 175 bps, resulting in all-in cost of debt around 5%. At the same time, successful bidders have to adjust their equity return expectations to the competitive situation and to the fact that PV power plants have historically proven to be low-risk investments.

The two forerunners apparently got the equation of rock-bottom EPC cost, optimized O&M concept and low-cost finance right.

At the same time, local experience appears to be a crucial ingredient for success. Acwa Power and ALJ are among the most prominent industrial companies in the Gulf region, and as such have vast experience in local tender processes and longstanding relationships to key partners such as banks and local contractors. Apricum anticipates that foreign companies on their own without significant experience in the Gulf region will likely find themselves in a tough position in future PV tenders.

A catalyst for renewed momentum in renewable energy in the Gulf region

The tender process so far has proven to be a resounding success for DEWA, with the process undoubtedly being run in a transparent and professional manner with only minor delays vis-a-vis the announced schedule. This achievement is particularly noteworthy as the first phase of the Sheikh Maktoum solar park project, a 13 MW project tendered on an EPC basis, was generally considered to be a somewhat ill-conceived, overly complex and potentially biased tender, in which many reputable firms eventually refused to participate.

Now DEWA will have to demonstrate that it can deliver on the promises made, select a winner in a transparent manner and drive the project through financial close and execution. At the same time, and even more so driven by Acwa Power’s provocative alternative bids, DEWA may want to reconsider and potentially accelerate the timing of the future extension steps of the Sheikh Maktoum solar park.

Looking ahead, a key challenge in the Gulf region will be to further develop the tender framework for renewable-energy projects. The precedents used by DEWA for the current project are all designed for conventional power projects, typically requiring investments of several hundred million or even billions of dollars, which dwarfs the investment of probably less than 150 million USD for the Phase II solar project. In relation to the project size, the tender mechanics appear bloated; in addition, PV technology is much less complex than conventional power plants, which also means that there is a disparity between the technical provisions in precedents and the rather minimalistic requirements of PV power projects. The amount of documentation and legal work for the bid was enormous; on the other hand, it has been demonstrated in other jurisdictions such as Germany that the legal and financial overhead for PV power plants can be massively reduced, with small utility-scale power plants essentially being financed by local banks using simple form sheets. A key challenge for the efficient deployment of more renewable-energy capacity in the Gulf region will be to adapt the conventional power precedents and to simplify them such that the overhead for mid-size projects is still manageable. If this marriage is achieved, the speed and flexibility of renewable-energy deployment can be further increased, with a more distributed nature of medium-scale projects, which would still enable each to attract a healthy amount of competition.

In addition, the financial industry in the Gulf needs to grow more accustomed to renewable-energy project finance, so that more local and regional banks are willing to provide low-margin finance for such projects. Although the appetite does already exist, the basis of regional banks that are willing to fund and to provide competitive terms is still thin. At the same time, currently evolving financial innovation, for example yieldcos, could further drive down the cost of financing and thus the tariffs.

In summary, the DEWA project results can be expected to have a lighthouse effect for the development of renewable-energy projects in the Gulf region, demonstrating that the cost-effectiveness and scalability in particular of solar PV technology has still been widely underestimated. We expect the momentum for renewable energy in the region to pick up significantly after this long-awaited and necessary milestone.

Most importantly, all eyes now rest on Saudi Arabia.

For any questions or comments, please contact Nikolai Dobrott.