While Saudi Arabian company ACWA Power has been making headlines recently for its record-breaking solar bids in Dubai, there are still many Saudi companies considering how best to enter the renewable energy market. In this interview, we ask Dr. Amer Alswaha, Apricum senior advisor based in Saudi Arabia and the former head of Saudi Electricity Company’s IPP program, about the opportunities for Saudi companies in the renewable energy sector. Dr. Alswaha also shares his view on the key learnings for Saudi authorities to consider in building a renewable energy program.

Dr. Alswaha, other countries in the MENA region, such as the UAE, Jordan, Morocco and Egypt, have built significant momentum in renewable energy, what can Saudi authorities learn from their examples?

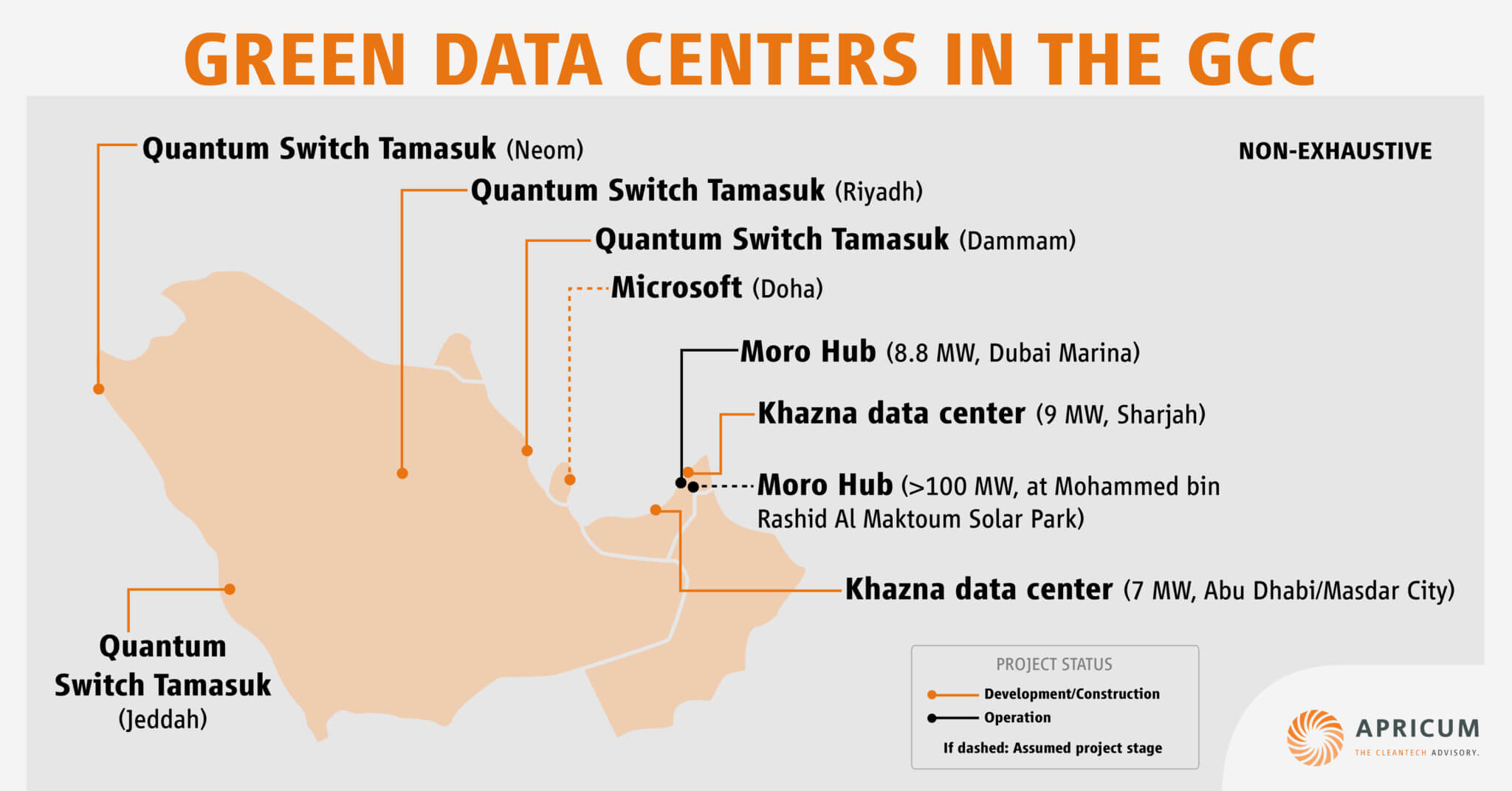

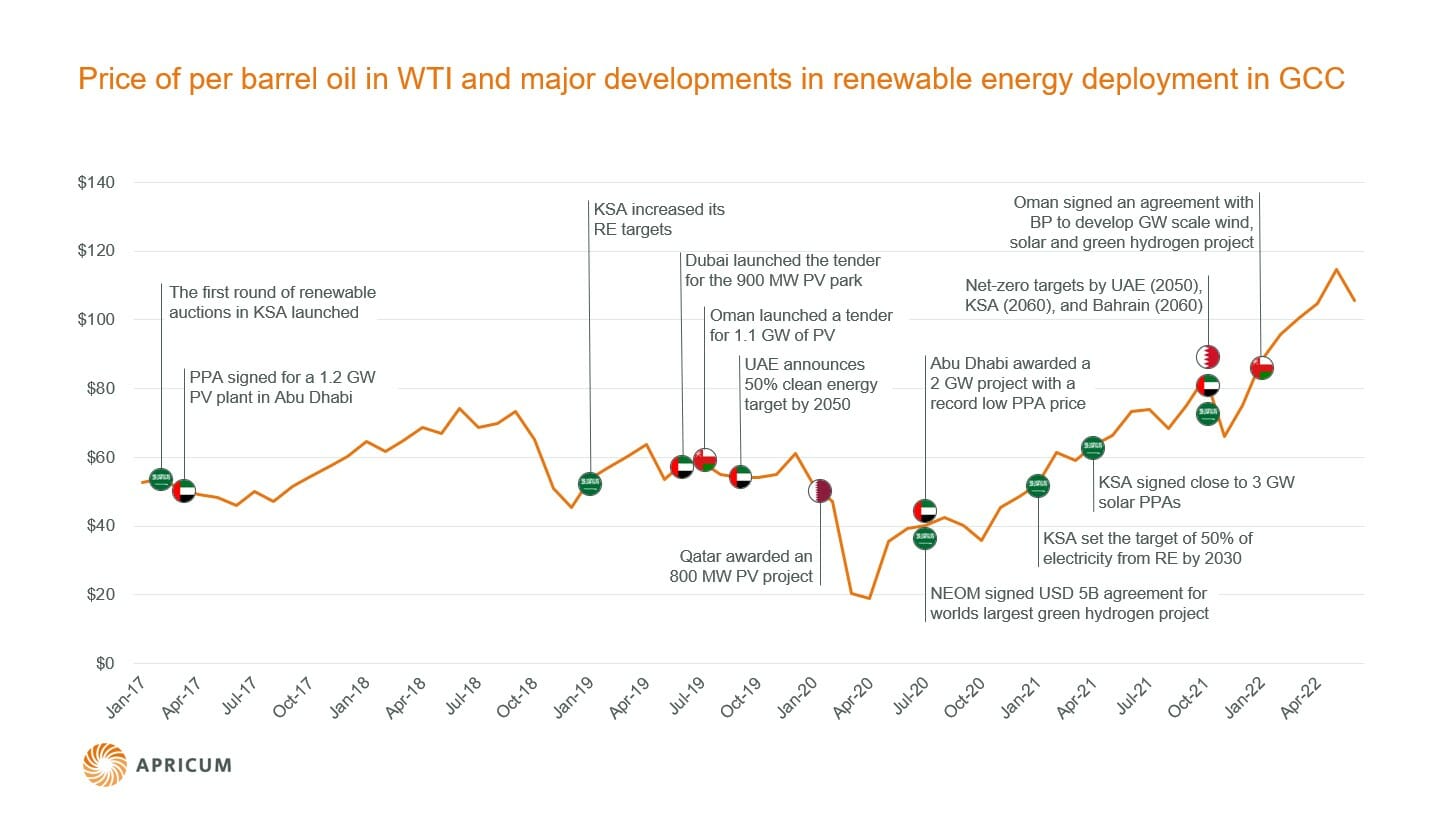

The pace of introducing renewable energy projects has accelerated recently in the MENA region with a general trend of competitive IPP tenders, excluding Egypt. So far, the UAE has been the most active in the GCC, largely driven by initiatives in Dubai with the 1 GW Mohammed bin Rashid Al Maktoum Solar Park. Morocco is implementing a similar program; however, in place of PV it is running competitive tenders for large-scale CSP projects. So far, the 160 MW Noor I project is being constructed and the Noor II and III projects, which account for a combined capacity of 350 MW, have been awarded. Jordan has also adopted the competitive model and, likely a result of smaller projects and a fixed price in the initial rounds, featured more local companies participating than in the UAE’s program. In Egypt, rather than massive mega-projects, we see a move towards numerous smaller projects using a feed-in-tariff program to build 4.3 GW of solar and wind projects in the next three years. Moving in a similar direction to encourage smaller projects, Dubai has announced plans for a net-metering program to allow small- and medium- scale rooftop installations.

Though the focus is often mainly on solar, wind energy has been gaining in prominence in recent years, particularly in Morocco and Jordan. The former received bids for 850 MW of wind power in 2014 and a 117 MW wind project in Jordan is under construction. With that, Morocco has become the MENA region’s leader in wind power and CSP. Egypt’s feed-in-tariff program will benefit from its early record of accomplishment with wind projects over the past 10 years.

If the goal of the Saudi Arabian authorities is local development, then they should closely consider the trends in these markets and design their program accordingly in order to attract Saudi and international renewable energy companies. To achieve that important local development goal, it is key that the eventual program has sufficient size of at least several hundred MW per year with a reliable timeline.

What progress can be observed in Saudi Arabia’s renewable energy efforts?

Since Saudi Arabia announced its renewables program about two years ago with ambitious renewable energy targets to meet by 2032, several steps have already been taken in creating a foundation for development. For example, measurement stations to build a national renewable energy resource atlas have been installed, and studies have been conducted to address grid connection and control requirements to deal with the intermittent nature of solar and wind power depending on the penetration level.

The program’s targets and its implementation steps, however, required a long-term commitment that necessitated a review process, particularly, with so many variables that have affected the local economy. For example, the government has made serious efforts to reduce energy consumption and improve energy efficiency via a range of projects addressing building insulation, air-conditioning, automobiles and public transportation. Furthermore, the government’s intention to use the unconventional gas resources in the western and northern parts of the country, as well as other factors, such as the recent volatility with oil prices, needed to be considered. The program’s extension from 2032 to 2040 was formally announced by H.E. Dr. Yamani, the president of K.A.CARE, at the recent World Future Energy Summit.

Saudi Arabia actually started more than thirty years ago to utilize the abundant solar irradiation with a solar PV system to provide electricity to a small town north of Riyadh. Later, SEC, Saudi Aramco, KAUST and some other universities started testing and building pilot systems using solar energy. In particular, SEC started to cooperate with Saudi Aramco to commission in 2011 the first solar IPP PV on-grid power plant with a capacity of 500 kW, to help the remote Farasan Island to become a “green” island, reducing fuel and transportation costs. In addition, tendering is in progress with the Green Duba and the Waed Ashimal projects, which will add 100 MW of solar power to the Saudi grid. As an extension of this cooperation, 300 MW of solar and wind projects are expected to be announced shortly. It is anticipated that these projects will be tendered using EPC contracts initially but could evolve to an IPP model, and will attract a lot of competition from all major developers and contractors. On the water desalination front, the commissioning of a new 15 MW solar PV facility to produce 60,000 cubic meters per day for the northeastern city of Al Khafji is expected in 2017.

Where do you see renewable energy opportunities for Saudi companies?

There are many good opportunities for Saudi companies to develop projects in the Kingdom and in regional markets; a good starting point is, of course, where the company already has a footprint or interest. Take the construction segment for example. This is a sector where Saudi companies have a long and successful history, and represents a good opportunity for Saudi companies to build solar power plants. Saudi companies can also potentially establish themselves in the manufacturing sector, offering locally produced polysilicon, wafers and modules as well as balance-of-system components including mounting structures and inverters.

As many areas in the Kingdom offer top-notch wind resources, wind energy projects will play a role in the Saudi renewables market. Given that this market will require significant local work, Saudi companies with compatible expertise, such as in large civil works, tower and pipe manufacturing and more, should investigate opportunities in the wind sector. Another considerable opportunity originates from the high cost of off-grid rural area power generation, where hybrid-RE solutions can be competitive.

There will be opportunities available for consulting services, EPC and O&M contractors, developers, vendors, financial institutions and indeed manufacturing facilities. Knowledge of other issues like secure and reliable grid connection, land availability and permitting, to name a few, will be critical success factors.

How can Saudi companies prepare themselves to get active in the renewable energy market?

Saudi firms have a long and well-established record of accomplishment in planning, arranging finance, engineering, constructing, operating and maintaining small and large-sized conventional power plants using fossil fuels. They only need to build their renewable energy industry knowledge if they have not yet, and be prepared to work with different execution approaches (EPC, IPP and FITs) by collaborating with experienced developers, manufacturers, contractors and lenders in order to qualify, bid, win and execute RE projects. Many tasks associated with renewable energy projects are common to other construction projects and manufacturing industries, like supply chain and electrical, mechanical and civil works. Identifying its own competencies and determining where in the value chain they can add value will provide a clear advantage to any Saudi company attempting to enter the renewable energy business.

In preparation for the Saudi program and building good references, we noticed the high participation of a number of leading national companies in the regional renewable programs that started recently. Aggressive pricing, arranging cheap finance, optimizing the bid preparation and a strategy of acceptance of low, long-term and steady returns for their investments make a good recipe for very cost-competitive bids.

A good example of how Saudi companies can become leaders in the development of Saudi renewable projects is ACWA Power, which produced a record tariff offer of 5.85 USD cents per kWh in the recent DEWA tender. ACWA first became a lead developer in the Saudi conventional IPP/IWPP projects and then moved to become a regional lead developer in renewable energy projects, particularly in Morocco and Dubai, as well as in other parts of the world. Another example of a successful partnership in the region is the alliance between Saudi Arabia’s ALJ and Spain’s FRV for the recent joint bid in DEWA’s PV tender, which was the second best. These examples show two versions of success for Saudi companies in the international renewable energy project development arena. The first case has been achieved through building on one’s own strength in the conventional IPP/IWPP business, and in the second case, by rapidly building knowledge through the collaboration with a globally leading developer.

What should Saudi companies consider when selecting a foreign partner?

Finding a suitable foreign partner, although it may not be a prerequisite for a future program, is an important consideration for local companies who wish to optimize their competitiveness. It’s an obvious way for Saudi companies to complement their competencies without needing to reinvent the wheel.

Firstly, Saudi companies need to identify what business they want to be in and the approach they wish to take. They then need to analyze the business models of potential foreign partners to determine with which companies they are best aligned. It is also important to understand the level of commitment of the foreign partner to the region and of course to make sure that both company cultures are relatively compatible. Other considerations include the form the partnership would take – it could be anything from a loose partnership agreement to a full JV. The list of accomplished projects of the foreign partner when it comes to moving into new countries is also a serious factor to contemplate. Managers should beware of mismatches in company scale, for example, massive conglomerates collaborating with small, nimble players. Since numerous global companies have already started to build their experience in Saudi Arabia, it is also important to check whether they have formed Saudi partnerships already. These are just some of the main considerations when choosing a partner. There are many other details to take into account that are dependent on the specific market and on the business models of the companies in question. That is why it is important to do your homework regarding key factors such as technology choices, channels to customers and detailed cost considerations.

Finally, do you think that the recent collapse of the oil price will affect the Saudi renewable program?

I do not think that it will affect the launch of Saudi Arabia’s renewable projects. The competitive advantage of using renewable energy in producing electricity compared with producing it by burning oil has not been affected by such a drop, even with the latest oil prices, because the price of solar power has also dropped, as seen in the recent DEWA project. In addition, the world is using less and less oil to produce electricity; oil’s share has dropped from 25% in 1973 to a mere 5% in 2012, according to the International Energy Agency.

In the Kingdom, where oil still constitutes a much higher share of electricity production, we see that the drop in oil prices has two offsetting effects on the national budget: it leads to both lower domestic oil subsidies (the difference between market price and the one charged to the utilities) and of course to a drop in oil revenue from exports.

I am optimistic about the Saudi renewable energy program; it may be starting slowly but it will grow very quickly and soon you will see the Kingdom as one of the leading nations in this industry. Renewable energy is the world’s future energy source, and for the Kingdom, it will help save fossil fuel resources, maximize oil revenue, boost the economy by creating jobs and help the environment by reducing harmful emissions. Much less than one percent of the Kingdom’s total land area is needed to produce all of the electricity needs for one year using solar power. Especially due to the significant decrease in the prices of PV modules, which dropped from USD 77/W in 1977 to around USD 0.67/W in 2014, solar was the fastest growing global power generation source in the last five years, and it can become the largest source of electricity generation by 2050.

For questions or comments, please contact Nikolai Dobrott, Apricum managing partner.