Satellite PV module manufacturing, the assembly of modules in factories in end markets around the globe rather than in highly centralized and vertically integrated facilities, is a growing trend in the PV industry. Manufacturing close to end markets has several advantages over centralized production – if it is done correctly.

This trend creates a clear opportunity for local industrial players in new PV markets wishing to enter the PV business. For these players to be successful, they must carefully consider their options from a strategic perspective.

In the past five years, the PV module manufacturing business experienced a process of consolidation, leading to the proliferation of huge, centralized PV module production facilities that are often combined with ingot, wafer and cell production and are mostly located in East Asia. From these factories, modules are shipped to destination markets around the world (historically mostly in Europe, but becoming more and more globally distributed every year). Spurred on by several factors, this model may slowly be changing to a so-called satellite PV assembly business model.

Local content rules, import tariffs and a desire to move products to market more rapidly all incentivize more localized module assembly for global players. In addition, local industrial companies in new PV markets aspire to enter PV manufacturing and often prefer module assembly as a market entry point because of its lower CAPEX requirements and fewer barriers to entry compared to activities further upstream. Examples of companies who have decided to manufacture modules in new PV markets include CSUN (Turkey) and Jinko Solar (South Africa); conversely, Philadelphia Solar (Jordan) and Desert Technologies (Saudi Arabia) are examples of local new entrants.

To judge whether a satellite manufacturing strategy makes economic sense compared to a centralized manufacturing strategy, one must consider two key questions:

1) Does the given market feature conditions that justify local PV manufacturing?

2) How are the key success factors (KSFs) in the PV module assembly business affected by both strategies?

A market feasibility study can quickly produce an answer to the first question. In a nutshell, to justify local PV module assembly, the market must be of significant size and provide a sustainable offtake. In answering the second question, there are two KSFs that affect competitiveness of PV module manufacturers more than all others: cost and bankability (i.e., ability of projects using your modules to obtain debt finance from banks).

Figure 1: KSFs for PV module manufacturing

| KSF 1: Cost | KSF 2: Bankability |

| Availability of raw materials at low price (cells, glass, backsheets, encapsulants, etc.) | Track record |

| Low utilities/labor cost | Certifications |

| Adequate scale of production | Perceived financial stability of module manufacturer |

| Guarantees/warranties |

From the perspective of a local new entrant, it will be a significant challenge to achieve a highly competitive cost position and bankability. Therefore, it is important that the new entrant has an offtake agreement for production or at least a likely offtake for a price that allows the company to maintain operations until it becomes more competitive. This can be supported by local content bonuses in the manufacturer’s local market and requires demand in the local market that can support a minimum production amount; the demand will most likely have to come from smaller scale commercial projects because large utility projects require significant debt financing and thus competitively priced and bankable modules.

From the perspective of a globally active, established PV manufacturer, the decision to assemble PV modules locally needs to be made on a case-by-case basis taking into account advantages and disadvantages of the two scenarios (see figure 2 below).

Figure 2: Advantages (+) and disadvantages (–) of satellite and centralized strategies for PV module manufacturing

| Satellite Assembly | Centralized manufacturing | |

| Cost | + Savings on shipping costs (cells cheaper to ship than complete modules)– Higher costs due to smaller scale of production, e.g., higher materials cost (local value chain likely lacking, smaller order sizes)+ or – Labor and power costs (varies by market) | + Full effect of scaling+ Can locate in market with favorable labor and power costs+ Can locate in market with easy access to value chain+ Favorable materials supply terms thanks to large orders– Higher shipping costs |

| Governmental intervention on behalf of local manufacturing | + Can take advantage of local content bonuses, if available (likely not permanent)+ Tariffs not applicable (at module level) | – Can only take advantages of local bonuses in home market– Potentially affected by tariffs (e.g., US import tariff on Chinese and Taiwanese PV products) |

| Time to market | + Module assembly facility is closer to end market (saving shipping time) | – Slower to market as all modules are shipped from central location |

| Local adaptations | + Production line can be adapted to produce products for local conditions, e.g., deserts, that can be sold at a premium | – Modules need to be generic enough to be sent to all markets |

| Bankability | Bankability is independent of the location strategy as it reflects the maturity of the product and of the manufacturer and not of the manufacturing location. | |

Clearly, there are advantages and disadvantages to both strategies. A global PV module manufacturer who is already bankable must weigh the potential higher costs of production against the benefits of improved time-to-market and of price premiums for local content and specialized modules.

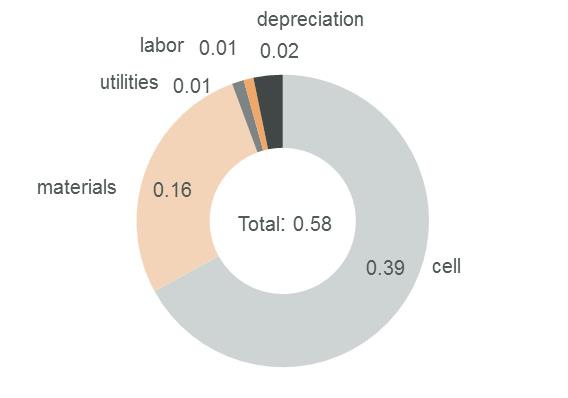

Figure 3: Exemplary centralized PV module production cost [USD/Wp]

Sources: Apricum PV system cost model Q2/2014, Apricum analysis

Sources: Apricum PV system cost model Q2/2014, Apricum analysis

In the above example, the total production cost for PV modules is USD 0.58/Wp (approximate 2014 global average for large-scale Chinese players). Producing at this cost allows for positive gross margins at a global module price of USD 0.65/Wp. Producing locally will likely increase production costs compared to this scenario; costs for module materials, utilities and labor could easily be higher in the local market, adding five to ten cents to the price per watt peak. On the other hand, logistics savings of USD 0.015/Wp should be attainable with satellite manufacturing and if a 5–10% local content price premium can be achieved on top of that, the operation could still provide a positive gross margin; potentially even more so than in the case of centralized production.

What is the best market entry strategy for a local industrial firm?

Assuming favorable conditions are in place for local PV module assembly (local PV market of significant size, adequate labor and utility prices, local content rules), what is the best strategy for a local industrial firm entering the market?

There are two major options: partner up with a global module manufacturer or go it alone and set up a factory with production equipment purchased from an equipment manufacturer. How do these two options stack up?

Option 1: Partner up

This option provides many advantages associated with having a strong partner. These benefits include bankability provided by partner, access to partner’s deep manufacturing process knowledge and an established track record. Furthermore, the partner can provide support for line installation, access to its large supply network (better prices) and sales support from its global clients.

Of course, there are some risks involved, primarily associated with reduced control of the business. There is potential for a lack of balance between partners (i.e. huge international company with small local outfit) and a smaller local player can become dependent on its partner. Finally, partners must share the proceeds of the business.

Option 2: Go it alone

There are a few advantages to taking the solo route. The new entrant can maintain total control over the business if it desires and will have the ability to create a completely independent brand.

There are, however, many risks to this strategy. Firstly, achieving bankability is a difficult process (it will take at least 2–3 years). The new entrant will also be very reliant on its equipment supplier for PV manufacturing know-how, which is likely not as strong as the companies actually doing the manufacturing. Furthermore, the new entrant will lack any PV track record and will likely face less favorable materials supply terms because of lack of scale.

The strategic decision whether to partner up or go it alone depends on the preferences and capabilities of the new entrant, but it appears the least risky way to market is through partnership with an existing player, if it can be managed. Of course, local players need to keep in mind that selecting the most appropriate partner and building a mutually beneficial strategy is no small task and requires great care.

The satellite PV module manufacturing model is appearing in several markets around the world, as mentioned earlier in this article, and is not likely to disappear in the near future. Prospective local and existing global PV manufacturers should be aware of the pros and cons of this strategy compared to the dominant centralized model. Cost is still king, but companies need to balance the added costs against the savings and potential price premiums that can be achieved with satellite manufacturing.

For questions or comments, please contact James Kurz, senior consultant: kurz@apricum-group.com