We speak to Apricum Senior Advisor Per Hornung Pedersen, former CEO of Repower and Suzlon, about the global onshore wind market and where he sees growth opportunities for wind project developers.

Mr. Pedersen, it has not always been smooth sailing for onshore wind players in the last few years in established markets such as Europe. They’ve had to cope with stagnating demand, intense competition, changing support schemes and shrinking margins. Where do you see opportunities for wind project developers?

It’s true that traditional onshore wind markets such as Europe and the USA, and China for that matter, which have always been relied upon to deliver large volume are no longer the place to find growth. Global growth is instead being driven by emerging markets such as Brazil, Mexico, Turkey and South Africa. This is where I would rather be looking to invest.

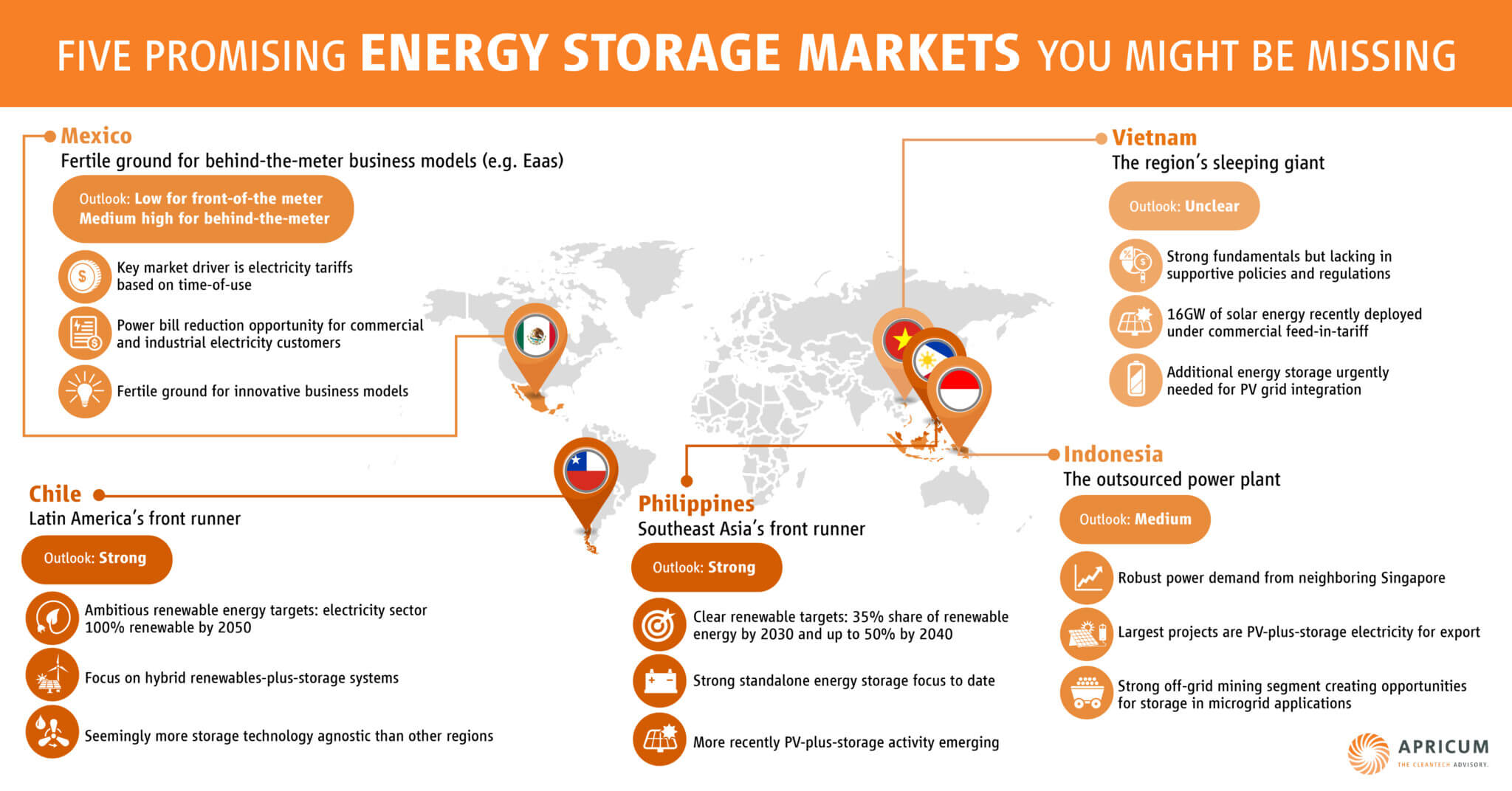

However, as competition in these markets is already heavy and increasing, developers should also investigate promising, but virtually “untapped” wind markets. Some countries in MENA, such as Saudi Arabia, Iran or Egypt as well as in Asia like Vietnam, Indonesia, Thailand and Kazakhstan would go on this list of countries with significant mid and long term growth potential.

What is driving the growth in these markets?

I see four major drivers. Firstly, these emerging markets have a rapidly growing energy demand and an urgent need to install additional power-generating capacity. Secondly, power production costs for wind are increasingly competitive with those for fossil fuels, thanks to falling system prices. Thirdly, the desire to diversify local industry and create jobs is very compelling. Last but not least, many countries aim to reduce their domestic consumption of fossil fuels to free up oil and gas for exports or increase their energy independence and reduce expensive foreign energy imports.

Looking ahead, I definitely see sustainable growth for these new wind markets; take Saudi Arabia, Mexico and Brazil for example.

In Saudi Arabia, K.A.CARE[1], Saudi Aramco and state-owned utility SEC[2] are looking into wind power and have already conducted on-site measurements as the initial step towards the first wind power installations. Expect to see major utility-scale wind development in Saudi soon.

In Mexico, the outlook for wind is extremely positive. The government is liberalizing the energy market extensively and is keen to increase the renewables share, especially for wind. Combine this with high electricity prices, Mexico’s excellent wind resources and land availability, and we will continue to see high growth figures for wind in the coming years.

In Brazil, we’ve seen a remarkable development in wind power over the past few years, which is driving down the cost of generation to an impressive USD 0.05/kWh and succeeding to stimulate local industry participation in the sector. This is why wind power has dominated the governmental power auctions in Brazil last year, winning licenses for 4.7 GW of new wind generation capacity that will come online over the next few years. Additionally, Brazil is going through a painful period of drought that has revealed the vulnerability of its hydro-dominated generation mix and has sent power prices soaring. Wind power will be one of the means to diversify the generation mix, so I expect substantial further investment in the coming years.

[1] King Abdullah City of Atomic and Renewable Energy

[2] Saudi Electricity Company

That all sounds well and good, but don’t many of these markets also have significant constraints? For example, many emerging markets have specific local requirements. How can these challenges be overcome?

This is true and that’s why having the right partnering strategy is crucial. The wind markets in emerging countries are still immature and lack the experience and knowledge of the established markets. Experienced foreign companies naturally lack the local market knowledge and access to projects and funding. Finding a suitable local partner company can quickly build up the required business network and close critical gaps in capabilities.

I understand that global demand for wind power is becoming increasingly spread geographically over a larger number of markets. Are there any resulting challenges a wind developer has to be aware of?

Yes, there are. The rising number of potential countries for market entry has to be screened and prioritized carefully along both individual and interrelated criteria. I’m talking here about the cost of reaching customers as well as customer acquisition across geographically diverse markets. Also, whether to take a regional cluster risk or accept a greater effort to manage globally spread markets is an important decision.

It sounds like there is quite some risk and cost involved. What advice would you give to an onshore wind developer who has his sights set on internationalization?

Do your homework and be sure to have a well-constructed game plan. Developing a comprehensive internationalization strategy with individual market-entry strategies that can balance potential, risk and resources is critical. I would also reiterate the importance of a sound partnering and funding strategy – finding a trusted, local company is vital, as is raising the necessary funds to finance internationalization.

For questions or comments, please contact Partner Florian Mayr, head of Apricum’s wind practice: mayr@apricum-group.com or +49 30 30 877 6228.